-

- پلتفرمهای معاملاتی

- اپلیکیشن PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- تاجر وب

- پی یو سوشل

Key Takeaways:

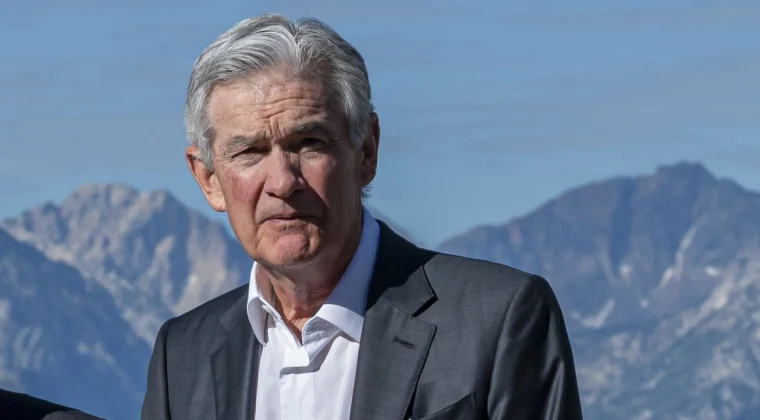

*Fed Chair Powell’s Jackson Hole remarks revived risk appetite, framing tariffs-driven inflation as temporary and signaling readiness for preemptive cuts.

*Equities surged, with tech and growth sectors leading, though fragile labor and GDP trends cast doubt on earnings resilience.

*Upcoming U.S. jobs and CPI data will be decisive for equity momentum, with risks of renewed volatility if inflation proves sticky.

Market Summary:

U.S. equities staged a powerful rally, with the Dow Jones gaining over 800 points, after Fed Chair Powell’s Jackson Hole remarks reignited risk appetite. Powell signaled a shift toward preemptive rate cuts to cushion labor market weakness, portraying tariffs-driven inflation as a one-off adjustment rather than a persistent threat. This framing alleviated stagflation fears and boosted hopes for renewed policy support, lifting valuations, particularly in rate-sensitive tech and growth sectors.

The move marks a potential “Fed put” moment, but the drivers remain fragile. Powell highlighted that job creation has slowed to just 35,000 per month, while GDP growth slipped to 1.2% in the first half of 2025—both warning signs for earnings resilience. Meanwhile, the bond market delivered a mixed verdict: short yields fell on cut bets, but the 30-year yield held firm, underscoring longer-term inflation risks and doubts over policy sustainability.

Looking ahead, the September 5 jobs report and September 11 CPI release will be critical in shaping equity momentum. A confirmed cut could extend the rally, but disappointing data or sticky inflation may quickly revive volatility, particularly given lingering political pressures on the Fed and uncertain U.S. trade policy.

Technical Analysis

Dow Jones, H4:

Dow Jones (DJI) is trading near 45,626, staging a strong rebound and breaking above the 61.8% Fibonacci retracement level at 45,635. The move marks a continuation of the index’s bullish momentum, with price holding comfortably above the 20- and 50-period moving averages, reinforcing the constructive outlook.

Momentum indicators suggest further upside potential. The Relative Strength Index (RSI) is approaching 70, signaling strong bullish momentum, though nearing overbought conditions that could slow the pace of gains. The MACD remains firmly in positive territory, with a widening histogram and bullish crossover supporting continued upward pressure.

On the upside, a decisive close above 45,635 would strengthen the case for a move toward 47,743 if momentum persists. On the downside, initial support rests at 44,155, followed by stronger levels at 42,675. A break below these zones could shift momentum back in favor of sellers and trigger a deeper retracement.

Resistance level: 45,635.00, 47,743.00

Support level: 44,155.00, 42,675.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

ہمارے پریشانی مفت عمل کے ساتھ PU پرائم لائیو اکاؤنٹ کے لئے سائن اپ کریں.

بغیر کسی تکلیف کے اپنے اکاؤنٹ کو وسیع چینلز اور قبول شدہ کرنسیوں کے ذریعے فنڈ کریں۔

مارکیٹ لیڈنگ ٹریڈنگ حالات کے تحت سینٹوں کی تعداد تک رسائی حاصل کریں.