-

- پلتفرمهای معاملاتی

- اپلیکیشن PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- تاجر وب

- پی یو سوشل

*Yen rebounds after sharp losses as safe-haven demand returns

*Finance Minister Kato signals possible intervention to curb excessive weakness

*Market volatility rises amid Trump’s new tariff threats on China

Market Summary:

The Japanese yen recovered late last week after suffering a sharp drop earlier, as renewed market tensions spurred safe-haven demand for the currency. Despite the rebound, the yen’s broader trend remains weak amid expectations that Japan’s new government will adopt a more expansionary fiscal and monetary stance to stimulate the economy — a policy mix that could weigh further on the yen through increased money supply and inflation pressure.

The currency stabilized after Finance Minister Katsunobu Kato warned that authorities may consider intervention measures if excessive currency weakness persists. His comments provided temporary relief to the yen, helping it claw back some of its earlier losses.

However, global sentiment turned fragile over the weekend as former U.S. President Donald Trump vowed to impose aggressive tariffs on Chinese imports, heightening tensions between the world’s two largest economies. The move sparked a broad market selloff across equities and cryptocurrencies, reviving risk aversion.

With the dollar retreating on renewed safe-haven flows, investors turned back to the yen as a defensive play, helping the currency stabilize heading into the new week.

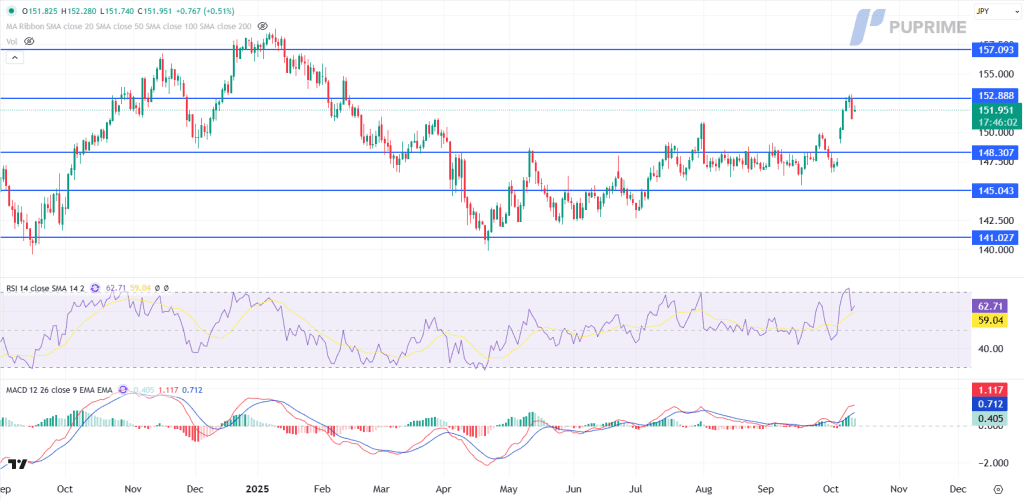

The pair remains in a broader uptrend but is currently consolidating near the strong resistance level of 152.90. A bearish engulfing pattern has formed, suggesting potential for near-term downside. Should bearish momentum persist, the pair may retest the next support at 148.30.

Momentum indicators reflect growing downside risk — the MACD shows diminishing bullish momentum, while the RSI has retreated sharply from overbought territory to 63, signaling potential for extended losses.

However, if fundamentals turn in favor of dollar strength and the pair breaks decisively above 152.90, the next upside target could be 157.10.

Resistance Levels: 152.90, 157.10

Support Levels: 148.30, 145.05

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

ہمارے پریشانی مفت عمل کے ساتھ PU پرائم لائیو اکاؤنٹ کے لئے سائن اپ کریں.

بغیر کسی تکلیف کے اپنے اکاؤنٹ کو وسیع چینلز اور قبول شدہ کرنسیوں کے ذریعے فنڈ کریں۔

مارکیٹ لیڈنگ ٹریڈنگ حالات کے تحت سینٹوں کی تعداد تک رسائی حاصل کریں.