-

- پلتفرمهای معاملاتی

- اپلیکیشن PU Prime

- PU Copy Trading

- PU Web Trader

- MetaTrader 5

- MetaTrader 4

- پی یو سوشل

While both shares trading and trading CFDs allow you to profit from changes in stock prices, CFDs, which is the abbreviation for Contract For Differences, have several advantages over conventional shares trading.

The financial instrument known as a CFD, or “contract for difference,” enables traders to speculate on the price changes of various assets without actually holding the underlying commodity. As a result, traders are able to purchase or sell CFDs on a variety of assets, including stocks, indices, commodities, and currencies, and eventually make a profit or loss based on the difference between the prices at which they open and close their positions.

To know more about CFDs, please click here to read more.

Alternatively, shares signify ownership in a business. You become a shareholder of a corporation when you purchase shares, and you are then eligible to receive a share of its assets and profits. Additionally, shareholders have the right to vote at shareholder meetings, as well as receive dividends should a company wish to pay them.

To know more about Shares and trading them, please click here to find out more.

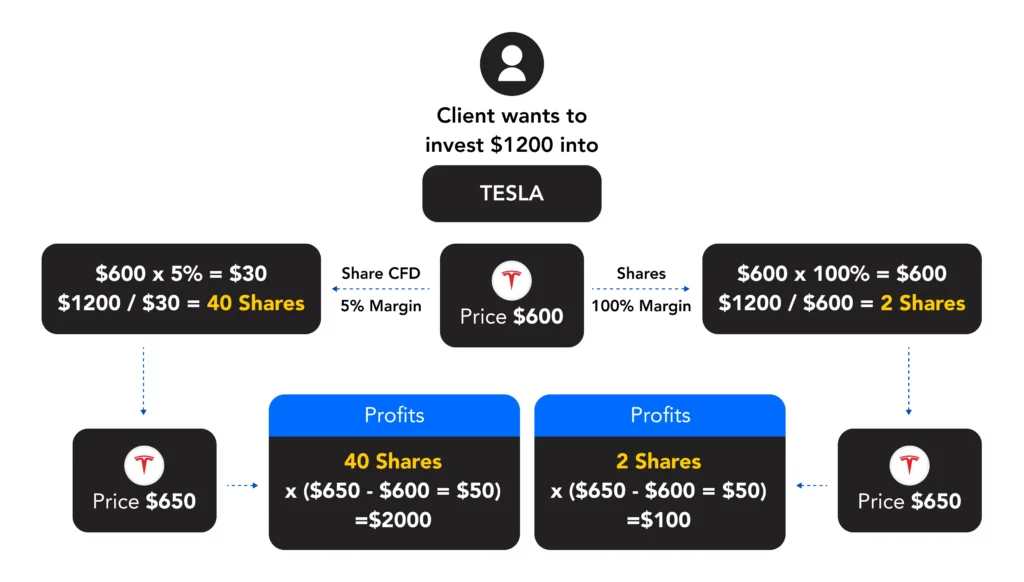

One of the main differences between CFDs and shares is that CFDs are traded on margin, which means that traders only need to put up a small percentage of the full value of the trade. This allows traders to potentially make larger profits, but it also means that they can also incur larger losses. Shares, on the other hand, must be purchased in full in most cases, and traders cannot use leverage to increase their potential profits or losses.

Another difference is that CFDs are typically traded over-the-counter (OTC), which means that they are not listed on an exchange and are not regulated in the same way as shares. This can make CFDs more risky for traders, as there is no central authority overseeing the market. Shares, on the other hand, are typically listed on exchanges and are subject to regulatory oversight, which can provide some protection for investors. To understand further on the difference between a share trade and a CFD trade, below is an illustration of using traditional share trading and share CFD trading on Tesla stock.

In summary, CFDs and shares are two different financial instruments that allow traders and investors to speculate on the price movements of various assets. CFDs are traded on margin and are typically traded OTC, while shares represent ownership in a company and are traded on exchanges. Both have their own unique risks and benefits, and traders and investors should carefully consider which is the right choice for them based on their investment objectives and risk tolerance.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

ہمارے پریشانی مفت عمل کے ساتھ PU پرائم لائیو اکاؤنٹ کے لئے سائن اپ کریں.

بغیر کسی تکلیف کے اپنے اکاؤنٹ کو وسیع چینلز اور قبول شدہ کرنسیوں کے ذریعے فنڈ کریں۔

مارکیٹ لیڈنگ ٹریڈنگ حالات کے تحت سینٹوں کی تعداد تک رسائی حاصل کریں.