-

- پلتفرمهای معاملاتی

- اپلیکیشن PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- تاجر وب

- پی یو سوشل

*The central bank slashed its cash rate by 50 bps to 2.50%, double expectations, driving NZD/USD to a six-month low of 0.5738.

*Policymakers cited sluggish consumer and business spending and projected economic contraction through mid-2025.

*Dovish guidance and widening rate differentials signal sustained downside risk for the kiwi ahead of the November meeting.

Market Summary:

The New Zealand dollar faced intense selling pressure during the session, with NZD/USD falling to a six-month low of 0.5738 and GBP/NZD rising to its highest level since April. The sharp depreciation followed an unexpectedly aggressive policy move from the Reserve Bank of New Zealand, which cut its official cash rate by 50 basis points—double the 25 bps reduction markets had anticipated.

The RBNZ’s decision was driven by mounting concerns over a stalled economic recovery, reflected in weak household and business spending indicators. The central bank specifically cited projections for softer-than-expected growth through mid-2025, with economic data suggesting contraction in the second quarter and subdued activity extending into the third quarter. This deteriorating outlook prompted policymakers to implement more substantial stimulus to safeguard the economy.

Perhaps more significantly, the central bank explicitly signaled openness to further easing should the recovery falter, strongly hinting at another potential rate cut at its November meeting. The RBNZ’s benchmark rate now stands at 2.50%, creating a widening interest rate differential with most major peers that is likely to sustain downward pressure on the currency in the medium term.

The combination of surprise easing, dovish forward guidance, and deteriorating growth fundamentals suggests the New Zealand dollar will remain vulnerable in the coming months. Market participants are likely to continue pricing in additional monetary support, potentially extending the currency’s bearish trajectory unless global risk sentiment improves substantially or domestic data surprises to the upside.

Technical Analysis

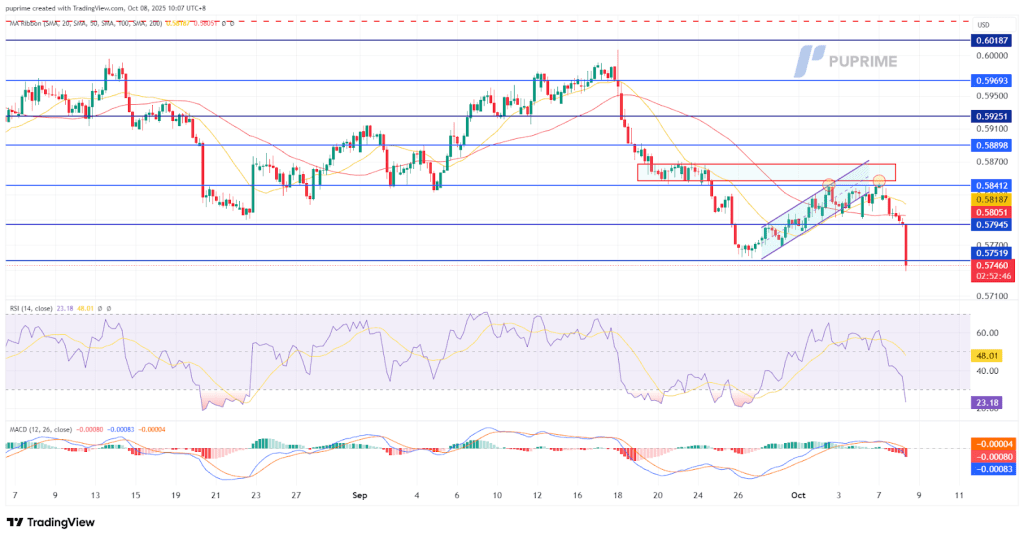

The NZD/USD pair has extended its downward trajectory, declining nearly 2% to establish a fresh six-month low after being rejected during a technical rebound attempt. The formation of a double-top pattern beneath a key liquidity zone provides strong technical confirmation of the bearish bias, indicating that sellers remain firmly in control.

The breakdown follows the Reserve Bank of New Zealand’s surprise 50 basis-point rate cut and subsequent dovish guidance, which has fundamentally reshaped the currency’s outlook. The pair’s inability to sustain any meaningful recovery underscores the persistence of selling pressure, with the double-top formation signaling a failure to overcome resistance despite oversold conditions.

Momentum indicators are aligned with the deteriorating price action. The Relative Strength Index has declined into oversold territory, reflecting intense selling pressure, while the Moving Average Convergence Divergence has generated a bearish crossover—often referred to as a “death cross”—and is now crossing below its zero line. This configuration suggests that bearish momentum is not only present but accelerating.

Resistance Levels: 0.5800, 0.5840

Support Levels: 0.5700, 0.5650

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

ہمارے پریشانی مفت عمل کے ساتھ PU پرائم لائیو اکاؤنٹ کے لئے سائن اپ کریں.

بغیر کسی تکلیف کے اپنے اکاؤنٹ کو وسیع چینلز اور قبول شدہ کرنسیوں کے ذریعے فنڈ کریں۔

مارکیٹ لیڈنگ ٹریڈنگ حالات کے تحت سینٹوں کی تعداد تک رسائی حاصل کریں.